Center for International Business Valuation

Connect with Our Business Valuation Experts

A Research, Consulting, and Education Company Dedicated to the Business Valuation Profession

Business Valuation & Advisory Services

Research

Training

Consulting

The Center conducts valuation engagements, valuation reviews, and due diligence analysis, forensic engagements, financial management advisement

Financial Data Analysis

Helps valuation professionals make informed decision through research and data analysis

The Center organizes annual conferences, bi-monthly webinars, periodic discussion sessions, and valuation community practice sessions

The Center also provides project and program management support to small and large valuation projects

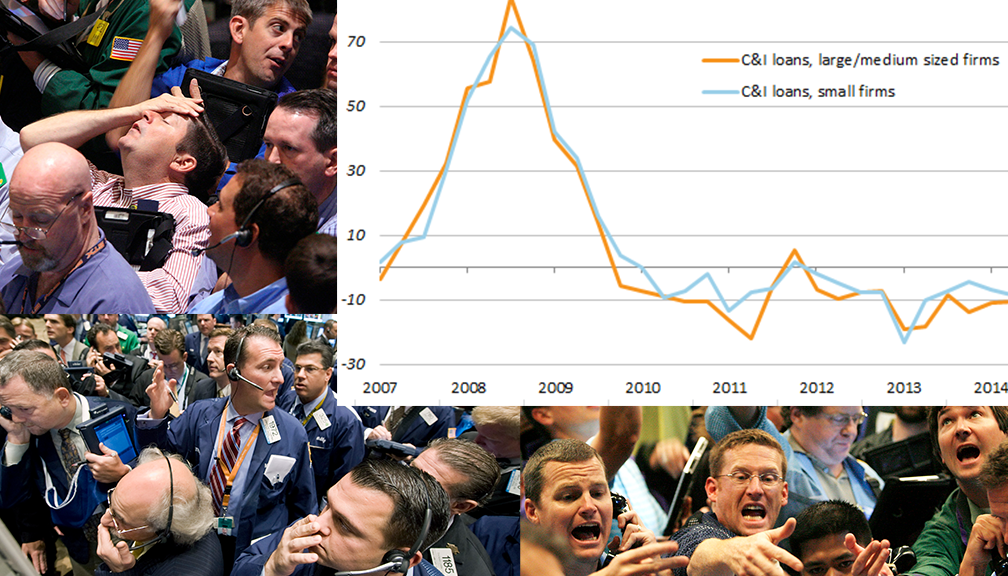

Is the World Ready for Another Financial Meltdown?

In the world of accounting and valuation, much consternation exists among CPAs, Government Auditors, Financial Analysts, and Credentialed Valuators regarding the determination of the fair value of financial instruments. Both the Securities and Exchange Commission (SEC) and the Public Company Accounting Oversight Board (PCAOB) have identified the fair value reporting of financial instruments as one of the top priorities needing improvements. Most prominent among the reasons given for the failures to accurately determine the values of these financial constructs is the complexity of these instruments, which are steadily increasing as a result of enhanced computing capabilities

The Need for Uniform Standards in Valuing Financial Instruments

As financial reporting requirements evolve and regulatory oversight intensifies, accurate and consistent valuation of complex financial instruments is more important than ever.

“Financial reporting requirements related to complex financial instruments have continued to increase along with regulatory scrutiny on valuation-related conclusions.”

– Alok Mahajan

At the Center for International Business Valuation (CfIBV), we recognize the growing demand for specialized training in this area. The valuation of these instruments impacts accounting, taxation, and business valuation, requiring professionals to stay informed and equipped with current methodologies.

Responding to KPMG’s Regulatory Valuation Priorities Through Expert Training

ASC 805

Provides guidance on acquisitions or mergers with another institution

ASC 815 and IAS 39

Periodically estimates the fair value of derivatives

ASC 820

Remeasures the fair value of contingent consideration

ASC 718 and IRC 409A

Awards equity-based securities to employees

ASC 470

Bifurcates convertible debt into debt and equity components

ASC 825

Elects the fair value option for financial assets and liabilities

ASC 820

Measures the value of complex securities for financial reporting purposes

ASC 326

Estimate allowance for current expected credit losses (CECL) over the asset’s life

IRC 275-4(b), IRC 108, IRC 249-1, and IRC 482

Seeks certain tax deductions or planning strategies regarding fixed-income instruments

WE ARE READY! Through our “International Certified Valuation Specialist with Advanced Financial Instruements (ICVS-A) training we are ready to:

ICVS-A: Advanced Financial Instrument Valuation Training

International Certified Valuation Specialist – Advanced (ICVS-A)

Master the skills to value complex financial instruments with confidence.

This specialized training covers:

-

Fair value accounting standards and disclosure requirements

-

Valuation of equities, debt, derivatives, and structured products

-

Use of Python with advanced financial libraries developed by CfIBV

Designed for valuation professionals, analysts, auditors, and finance experts looking to deepen their expertise and meet global standards.

Join the Growing valuation Community